API Manufacturing: Product Safety

The Active Pharmaceutical Ingredients (API) manufacturing industry is becoming more complex with countries in Asia moving aggressively to supply ingredients to regulated markets such as US and Europe.

While the US and European pharmaceutical industries are experiencing little or no growth in this market segment, Asian producers are seeing high growth rates, both from domestic demand and export sales. According to statistics, Chinese API producers generated estimated revenues of US$4.4 billion in 2005 and are projected to achieve sales of US$9.9 billion in 2010. Indian API producers accounted for about US$2 billion in sales in 2005. This figure is projected to grow to US$4.8 billion in 2010.

Chinese pharmaceutical companies are primarily oriented towards supplying their own domestic market and tend to place less emphasis on external Good Manufacturing Practice (GMP) compliance. Indian API manufacturers, on the other hand, are focused on export sales to highly regulated global markets. These manufacturers have developed considerable expertise in complying with global GMPs and supplying documentation to foreign regulatory agencies.

With the rising costs of pharmaceutical products and the emergence of low-cost competitors, manufacturing efficiency is becoming more important to Asian API manufacturers. The latter are looking toward regulated markets for growth - which means complying to GMP. The issue of cost and safety for the producers of API manufacturing equipment is also a significant driver for growth in this industry.

Approximately, 80 percent of the APIs used in the US and the European Union (EU) to manufacture finished pharmaceutical products come from Asia, with China and India accounting for much of the supply. An increasing number of manufacturing facilities for APIs have relocated to Asia. However, foreign manufacturers have concerns about producing certain proprietary drug products in Asia, due to weak intellectual property protection laws.

Some Asian countries make it difficult for small foreign support companies that provide validation, quality, laboratory and technical consultant services, to establish local businesses and to enter the market. As a result, many larger foreign and local API and pharmaceutical companies have to import these knowledge-based services at a higher cost than it could have been provided for local businesses.

Quality and Safety Issues

Asian API and drug manufacturers can achieve regulatory compliance and avoid production stoppages and recalls by following the guidance issued by the US Food and Drug Administration (US FDA) and the European regulatory agencies. In addition, manufacturers must also understand that education and training are a key business investment that will produce safe and effective products in the long run.

International regulatory bodies have published various types of guidance. For example, Annex 18 - EU Good Manufacturing Practices Active Pharmaceutical Ingredients (APIs); Pharmaceutical GMPs for the 21st Century - A Risk-Based Approach Final Report; Quality Systems Approaches to Pharmaceutical Current Good Manufacturing Practice (GMP) Regulations.

The US FDA has also published a process validation guidance document titled, "Process Validation: General Principles and Practices".

The aim of these documents is to help both the US and international manufacturers to produce drugs more efficiently. This should help to lower costs and to prevent shortages of critical medicines due to manufacturing failures that can result in product seizures and recalls.

The documents are not intended to create requirements for pharmaceutical manufacturing that go beyond those established in the current regulations, nor are they intended as a guide for the conduct of US FDA and EU inspections.

Japan is currently the leader in understanding the regulatory and compliance requirements that are needed to produce a high quality pharmaceutical product.

India's pharmaceuticals industry has been one of the fastest growing sectors in its economy. The country is now one of the most important healthcare markets in the world, having its own domestic market as well as a pool of clients for exports. Moreover, India is considered to be ahead of China in terms of its control of quality in pharmaceuticals manufacturing.

Growth and Regulatory Concerns

Where the US and EU manufacturers used to supply 90 percent of global API demand 20 years ago, they are now producing less than 20 percent. At the same time, while generic medicines accounted for less than five percent 20 years ago, they now make up for over 50 percent, with much of the API coming from Asia.

Figure 1 shows the cost structure differential between European/ US manufacturers and manufacturers in India and China. Key to numerical superscripts:

(1) Includes cost of goods sold excluding cost of raw materials.

(2) Assessment of direct personnel cost reduction from approximately €60 to €6 total salary dollars (tsd)/ Full-Time Equivalent (FTE) where1€=$1.25. Indirect personnel has a cost reduction factor of 2.

(3) Assessment of direct personnel cost reduction from approximately €6 to €3 tsd/FTE.

Consumers take it for granted that the medicines they buy are manufactured to the highest standards, and expect the regulatory authorities to ensure that this is enforced. In reality, there is a likelihood that the drugs on the shelves of European and US pharmacies may contain APIs that were made in Asian manufacturing facilities that have never been inspected.

Compliance with GMP regulations means that each of the batches of an API are of consistently good quality throughout the entire manufacturing process. Any changes to the process can only be implemented after their impact on quality has been assessed, and process change records must be kept so that all actions can be traced, if necessary. However, without a proper understanding of GMPs, the consistency and the quality of the batches cannot be assured. Deficient or non-conformance records also make investigations nearly impossible.

This means that problems are more likely to occur without being detected - ie, changes in impurity profile, cross-contamination with other APIs due to ineffective cleaning, or altered crystal forms or particle sizes, which can impact bioavailability.

Approaches to Inspections in Asia

The European Medicines Agency (EMEA) and the US FDA are attempting to address these problems by inspecting API and pharmaceutical manufacturing sites in Asia.

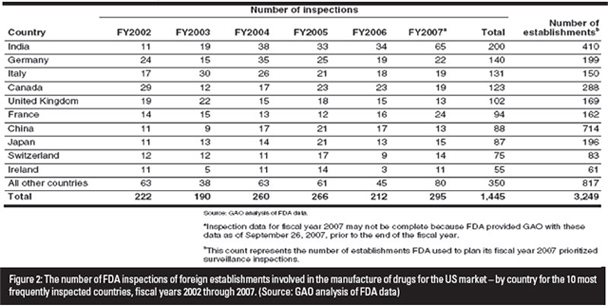

The US FDA database lists almost 7,000 foreign firms that import pharmaceutical products into the US. There have been criticisms that the number of inspections performed on these firms by the US FDA have been unrepresentative of the number of products imported. According to Cherry Lau, Senior Technical Executive, SGS Hong Kong, only 13 out of 714 Chinese exporters of pharmaceutical products into the US were inspected in 2007. In comparison, 65 out of 410 exporters were inspected in India.

Records indicate that an estimated seven percent of all foreign API facilities are inspected by the US FDA each year, compared to 97 percent of US facilities inspected every two years. Many pharmaceutical companies in the US have expressed that this is unfair, especially given that the levels of controls, deterrents or sanctions on foreign facilities are not of the same standards.

In 2007, warning letters were issued by the US FDA to two Chinese pharmaceutical manufacturers for GMP non-compliance, resulting in a denial of entry of the latter's products into the US. This reflects a rather high proportion of non-compliance as the two companies were part of a group of 13 Chinese importers that were inspected.

The US FDA uses a risk-based process to develop a prioritized list of foreign establishments. Inspections are conducted on these companies to monitor the quality of their marketed drugs. Few inspections however, are completed in a given year.

According to the US FDA, about 30 such inspections were completed in 2007 and at least 50 were targeted for inspection in 2008. Figure 2 indicates the number of foreign inspections that were performed from 2002 to 2007.

There are currently many uninspected facilities that export their products to the US and Europe. This has also led to a situation where European API manufacturers are also selling their ingredients to the US, as they are unable to compete in Europe, with the lower cost (and often uninspected) Asian imports.

Inspections in exporting countries are expected to increase primarily in both China and India. The organization has already opened affiliate offices in Chinese cities such as Beijing, Shanghai and Guangzhou. It has also assigned about 13 employees to certify the inspections of US-bound Chinese exports.

The foreign inspection process creates situations that are not encountered domestically in the US. For example, the US FDA relies on staff that inspect domestic establishments to volunteer for foreign inspections. Unlike domestic inspections, the inspection team does not arrive unannounced at a foreign establishment. There is also less flexibility to extend foreign inspections if problems are encountered, due to the need to adhere to an itinerary that typically involves multiple inspections in the same country.

Language barriers can make foreign inspections more difficult than domestic ones. The US FDA generally does not provide translators for its inspection teams. Instead, the teams may have to rely on an English-speaking representative from the foreign establishment being inspected, rather than on an independent translator.

Major Areas of GMP Concerns

According to statistical data based on inspection observations, the top 15 the major areas of GMP deficiencies by category are:

- Quality system elements/procedures documentation

- Design and maintenance of premises

- Design and maintenance of equipment

- Process validation

- Procedures and facilities sampling

- Manufacturing documentation

- Potential for microbiological contamination

- Specification and testing documentation

- Environmental monitoring

- Supplier and contractor audit and technical agreements

- Equipment validation

- Hygiene/clothing

- Duties of key personnel

- Potential for chemical/physical contamination

These deficiencies are an indication of a lack of understanding or commitment to GMPs. These types of GMP deficiencies cause concern among regulatory agencies, pertaining to the import of APIs and other drug related materials utilized in the production of finished drug products. There is a possibility that adulterated products may enter the US or European markets, due to either a lack of proper inspections or to the oversight of foreign companies.

There should be harmonization and guidance between the regulatory agencies and finished-drug manufacturers with supervision and inspections of foreign imports of APIs. To date, there has been a lack of guidance documents relating to the standardization of the auditing of APIs or other drug materials used in finished drug products. As a result, auditing standards are left up to the finished drug manufacturers who are sometimes under pressure to accept a vendor, based on cost and efficiency, rather than on quality and GMP compliance.

This is one of the reasons why there should be discussions on the development of global harmonization for second and third-party GMP auditing standards for the pharmaceutical industries.

Another suggested resolution is to have the regulatory agencies to certify or give approval to consultants or consultant companies to act on the agencies' behalf - to perform foreign inspections as per standard auditing practices.

Asian pharmaceutical and API suppliers require solutions that will enable them to ensure regulatory compliance and to address the global concerns on quality and authenticity.